1. Prepare Early

2. Keep Tabs On Your Expenses

3. Keep Your Records Organized

4. Know What Tax Breaks Are Available To You

Bonus Depreciation

Business Meal Deductions

Business Vehicle Expenses

5. Be Aware of Tax Law Changes

6. Turn to Trusted Experts

Taxes are something we love to hate, and hate to do, so it might not surprise you that 40% of business owners think it’s the worst part of owning a small business.

Taxes feel like the enemy, but they don’t have to be. The truth is, the more preparation you do, the more money you could save and the less time you’ll waste in the long-run. But how do you properly prepare? How do you get those tax savings?

If you’re unsure about what you need for tax time or how to make the most of your tax breaks, you’re in the right place.

Here are six tax tips for business owners:

1. Prepare Early

According to QuickBooks, 1 in 4 businesses delay tax preparation. We cannot stress this enough: do not delay! Always keep your records organized and start preparing for tax time now. Why? Your deadlines are sooner than you think.

For most people, tax time comes around once a year. As a small business owner, however, you have multiple tax deadlines to consider. Getting ahead and being prepared will only make those deadlines more manageable.

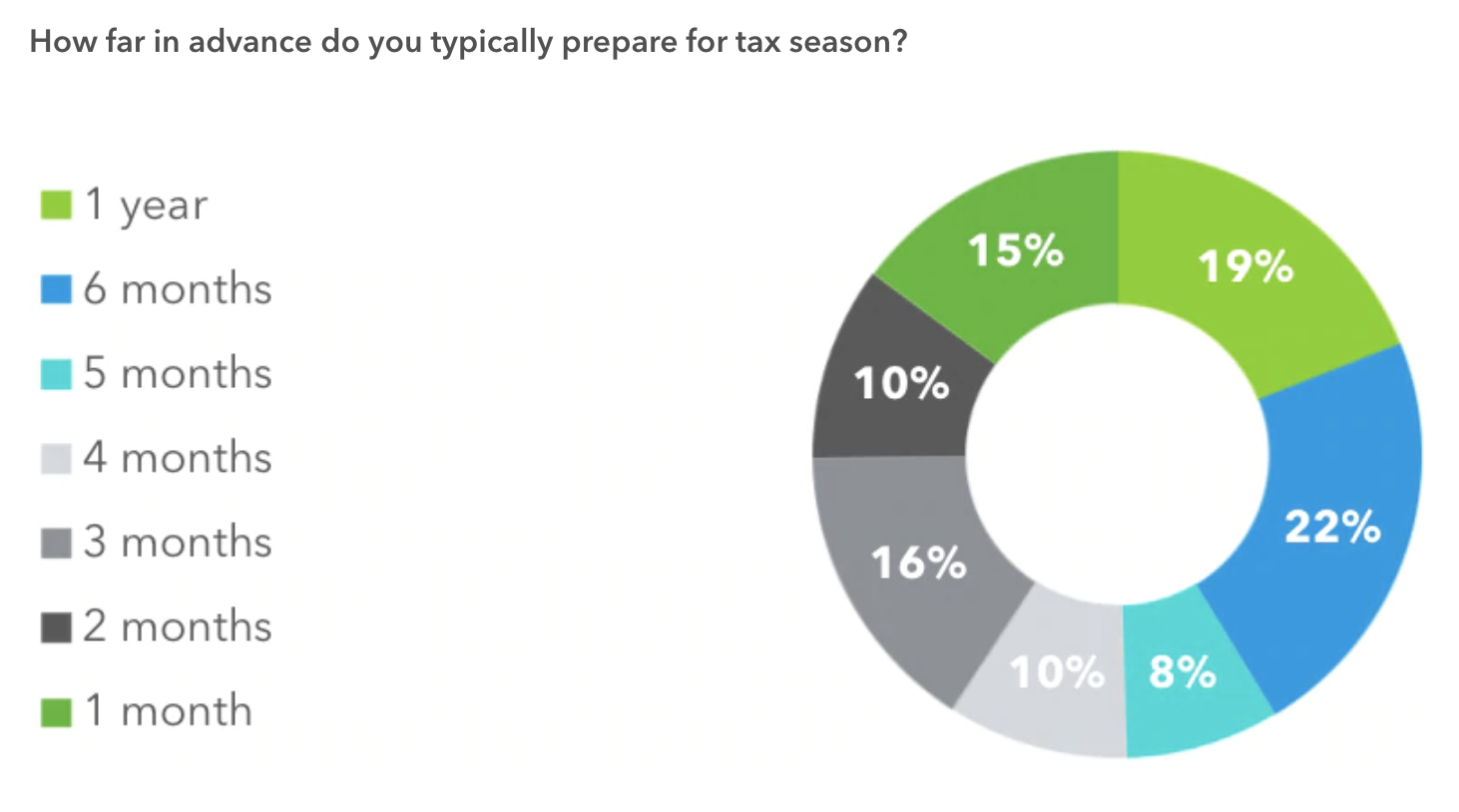

Image via QuickBooks

Pro-Tip: Keep a calendar of all your important tax deadlines. Click here to get a free calendar of important tax deadlines for small business owners.

2. Keep Tabs On Your Expenses

Tracking your expenses is key to preparing for tax time and could even help you get some tax breaks too (we’ll get to that in the next section). Our best advice for tracking your expenses is to keep your receipts organized and utilize a bookkeeper or bookkeeping software to keep tabs on your spending. Come tax time, or worst case scenario, if you get audited, you won’t be rummaging through a disorganized shoebox full of business receipts.

Expenses you should track:

Business meals and entertainment

Business travel

Receipts for client-related gifts

Home office expenses (if you work from home)

Expenses related to your vehicle

Pro-Tip: Find a finance software, like ScaleFactor, that will allow you to take a screenshot of your receipts and upload them directly to a mobile app. Never misplace important receipts again!

3. Keep Your Records Organized

When it comes to preparing your financial statements, your tax returns, and gathering files to send to your tax accountant, accurate and organized records are a must.

Here are some important records you should be tracking:

Receipts

Bills

Assets

Credit card statements

Purchases

Expenses

Canceled checks

Employment taxes (W2 and 1099 Forms)

Previous tax returns

Any correspondence with the IRS or state tax authorities

Operating agreements and capitalization table

Financial statements

Pro-Tip: Not only will a bookkeeper or bookkeeping software help you track your expenses, but they can help you track all your important financial records. These resources can be huge time-savers as accurate bookkeeping requires careful attention, every day.

4. Know What Tax Breaks Are Available To You

Bonus Depreciation

One of the tax-saving items to familiarize yourself with is bonus depreciation. Bonus depreciation was created by Congress to incentivize businesses to invest in capital assets. More importantly to business owners, bonus depreciation gives businesses more time to pay off their purchased assets and a deduction on eligible property purchased.

What can you deduct?

The qualifications for bonus depreciation vary. If you purchased qualified property after September 27, 2017 and started using it before January 1, 2023, that property is 100% deductible. If you purchased property before September 2017 and started using it before January 1, 2018, you can deduct that property at 50%.

How to claim: Use IRS Form 4562.

Business Meal Deductions

While the Tax Cuts and Jobs Act (TCJA) generally no longer permits businesses to deduct most entertainment expenses, you can still deduct business meals under certain circumstances.

As a general rule of thumb, you may deduct 50% of your business meals if they are reasonable, separately priced from your entertainment event, and if an employee is present. The meals may be provided to a current or potential business customer, client, consultant or similar business contact.

What can you deduct?

If there is a way to separate a meal expense from the event expense, that can be deducted. For example, if you order pizza to be delivered to your event, that can be deducted at 100%.

If you are traveling or an employee is traveling on business, those business meals can be deducted at 50%.

If you do something small and on occasion, like bring folks coffee at a staff meeting, you can fully deduct the cost of that meal. How to Claim:

If you are a sole proprietor or single-member LLC, you will claim your deductions under the “Expenses” section on Form 1040 (Schedule C), line 24b.

If you are in a partnership or multi-member LLC, you claim your deductions under the “Deductions” section on Form 1065, line 20.

If you are a corporation, you will claim your deductions under the “Deductions” section on Form 1120, line 26.

Business Vehicle Expenses

If you use vehicles in your small business, there are opportunities to deduct your vehicle expenses. If you use your vehicle only for business purposes, you can deduct its entire cost of operation, subject to certain limitations. If you use the vehicle for both business and personal purposes, you can deduct only the cost of its business use.

What can you deduct?

There are two deduction options for business vehicles. If you operate an efficient vehicle with little repairs, you will likely want to use the standard mileage rate. In 2019, the standard mileage rate is 58 cents for every business mile driven.

If your car is older and requires more gas/upkeep, you may opt for the actual cost method. For the actual cost method, it’s important to compile a list of actual costs (repairs, gas and oil, etc.) for operating your vehicle. To calculate your deduction on the actual cost method, you will multiply the combined cost of those items by the %age of miles you drove for business.

Pro-Tip: If you plan to deduct the cost of your vehicles, keep a log of your business miles and vehicle expenses.

How to claim: Most people will use one of the two methods above to calculate your deduction. If you are a sole proprietorship however, use Form 1040, Schedule C.

5. Be Aware of Tax Law Changes

Business owners must always be on top of it when it comes to tax reform, not just because it’s always changing, but also because it directly impacts the way you do business.

For example, in 2018, the Tax Cuts and Jobs Act made important deductibility changes relating to Meals and Entertainment expenses. As a result, some business owners adjusted their budgets to account for the fact that they could no longer deduct entertainment expenses.

Pro-Tip: Keeping track of the new tax laws, and more importantly, understanding their implications, can be difficult. If you’re feeling unsure or don’t have the time, consult a tax advisor to help you stay compliant.

6. Turn to Trusted Experts

Realistically, staying compliant is difficult when you’re busy running other areas of your business. If you find that you’re in need of a better solution to keep up with your tax obligations, you have options.

Outsourcing your tax needs can save you time and give you peace of mind. Working with a software like ScaleFactor is a cost-effective way to streamline your tasks and avoid costly penalties.

ScaleFactor is the smart accounting and finance software that is changing the way modern businesses operate. By automating complex accounting tasks and translating financial information into usable business insights, ScaleFactor is enabling business owners, managers, and entrepreneurs to focus on what they love: running and growing their business. Find out more about how ScaleFactor is solving the problems that businesses face every day at scalefactor.com.

Check out our newsletter

Monthly tips on running a business in your inbox.

Check out our newsletter

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.