Fair Labor Standards Act (FLSA): A Brief Primer

The Fair Labor Standards Act, or FLSA, lays out requirements for minimum wage, overtime, equal pay, record-keeping and more. What do you do if FLSA and local requirements differ? What about exempt and non-exempt employees? Read our FLSA guide to find out.

Exempt vs Non-Exempt Employees

Equal Pay

Recordkeeping

Child Labor

State and Local Requirements

Other Helpful Links

Introduced in 1938, the Fair Labor Standards Act, or FLSA, is a federal law which regulates minimum wage, overtime, equal pay, recordkeeping, and child labor.

The FLSA generally requires employers to pay employees at least the minimum wage for all hours worked and overtime pay at a rate of 1.5 times the employee’s regular rate of pay for hours worked over 40 in a workweek.

Those minimum wage and overtime laws don’t apply to certain exempt employees. You can find a list of who is exempt from those laws here.

Exempt vs Non-Exempt Employees

Employers are required to classify employees as non-exempt at time of hire, unless an exemption applies based on certain criteria determined by the Department of Labor (DOL) and state agencies.

As stated above, the FLSA requires most employees be paid at least federal minimum wage and overtime pay. However, exempt employees are exempt from that overtime pay and/or minimum wage.

In order for an exemption to apply, an employee’s job duties and salary must meet all the applicable requirements, including state requirements, if there are any. Because an employee’s job duties and/or pay may change over time, it’s a best practice for employers to regularly review the classifications for their employees.

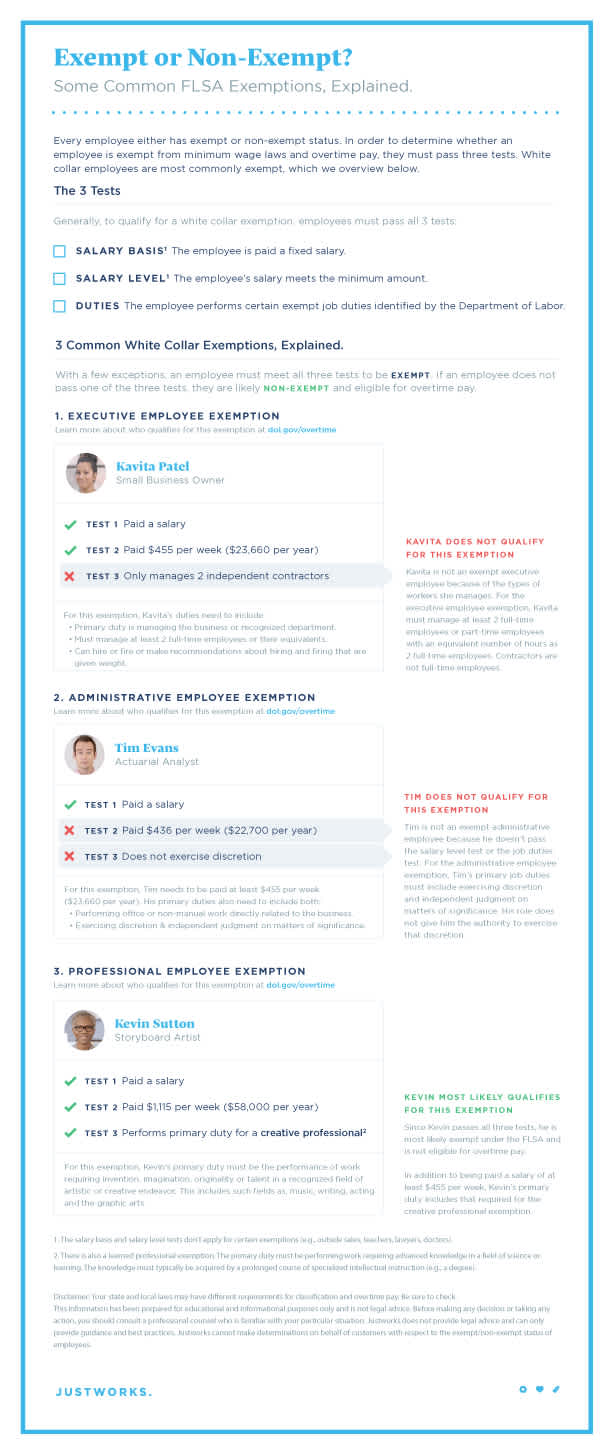

Figuring out whether an employee’s job duties meet the applicable duties requirements can be difficult. Make sure you understand the job duties requirements and apply them properly. We’ve created an infographic to help you understand some of the DOL’s common white collar exemptions.

Equal Pay

The equal pay provisions of the FLSA prohibit sex-based wage differences between women and men who work in the same establishment and perform jobs that require equal skill, effort, and responsibility and which are performed under similar working conditions. The Equal Employment Opportunity Commission enforces these provisions.

Recordkeeping

Employers are required to keep records on wages, hours, and other items as specified in DOL regulations, such as the employee’s home address and occupation. Records required for exempt employees differ from those for non-exempt employees. You can read the requirements here.

Child Labor

The FLSA’s child labor provisions are designed to ensure that when minors work, the work is safe and does not jeopardize their health, well-being or educational opportunities. You can learn more about details on child labor laws here.

State and Local Requirements

Some states and local jurisdictions have their own wage and hour laws, which may provide greater protection for employees than what is provided under federal law. Generally, where federal, state, or local laws conflict, the law that is most beneficial to the employee governs.For example, if a particular state or city requires a minimum wage that is higher than the current federal minimum wage, the state or city minimum wage applies. Ensure you’re familiar with the minimum wage and overtime requirements, and if necessary, check with counsel to ensure you have correctly classified your employees. For a quick resource that outlines some of the other pay requirements for your state, check out this DOL page.

Other Helpful Links

Knowing all you need to about the FLSA is a huge task. Here are some other sources of information that can help you out:

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.