Section 1 of I-9 Form

Employee Verification and Information

Section 2 of I-9 Form

Employer Review and Verification

Section 3 of I-9 Form

Updating and Reverification

Justworks Can Help

One of the most important forms that a business needs to have all new employees fill out is the Form I-9. This is a form from the Department of Homeland Security (DHS) to document verification of the new employee’s identity and his/her employment authorization. In essence, DHS wants to ensure every employee that you hire is legally allowed to work in the country.

The I-9 Form breaks down into three parts.

The Employee Information and Verification section, which includes all the basic information about that employee.

The Employer Review and Verification section, which is where the employer analyzes the documents provided by the employee.

The Updating and Reverification section, which is for special cases of employees. I’ll describe those below.

It is very important that employers do the form correctly and store them in a place that can be accessed within three days of the Department of Homeland Security requesting them. Unlike other forms, you don’t actually mail these in to DHS. If you don’t have them — or they’re done incorrectly — there can be significant fines assessed to your business. I-9 Form compliance is one of the most common and easily avoided compliance fines.

Because of this, understanding the I-9 Form is very important.

Want more info on the necessary forms around employment? Check out our guide to the W-2 form and to the 1099 form.

Section 1 of I-9 Form

Employee Verification and Information

Section 1 of the I-9 Form is relatively straightforward. Employees need to give their full name any other names they’ve ever gone by (including a maiden one), and their address. If they are a border commuter from Canada or Mexico, they may put that address. However, no other international address is acceptable.

While a birthday is required on the form, the employee doesn’t have to provide their social security number unless the employer participates in E-Verify. This is an online tool that will tell employers whether an employee is eligible to work for them or not. Finally, they don’t have to provide an email address or telephone number, but they can be useful if DHS needs to contact the employee for any reason.

The second half of page one is determining your citizenship or immigration status. It is broken down into the following four statements that every new employee must pick:

A citizen of the United States

A noncitizen national of the United States: This is a person born in American Samoa, some former citizens of the former Trust Territory of the Pacific Islands, and some children of noncitizen nationals born abroad.

A lawful permanent resident: This is someone who is not a U.S. citizen, but resides in the United States legally and has a lawfully recorded permanent address. Should this be the option, the new employee must write their Alien Registration Number or USCIS Number.

An alien authorized to work: This is for anyone that is neither a citizen nor a lawful permanent resident. If this is the case, the employee must provide two additional pieces of information:

If the employee obtained their number from U.S. Customers and Border Patrol, they must put their foreign passport information when they entered. If they obtained it from USCIS in the country, just put N/A.

To finish off, the employee must sign and date that all of the information they’ve provided is true. In the event that a translator or someone aside from the employee filled in the document, that person would give their information attesting to the validity of the information “to the best of my knowledge.”

That completes the first page, which is all the employee needs to worry. Everything else is employer provided.

Section 2 of I-9 Form

Employer Review and Verification

Step two of the I-9 Form is the Employer Review and Verification section. What an employer is doing here is basing a determination on the employee’s right to work in the country on a series of documents.

This page must be finished within three days of the employee starting work at your company.

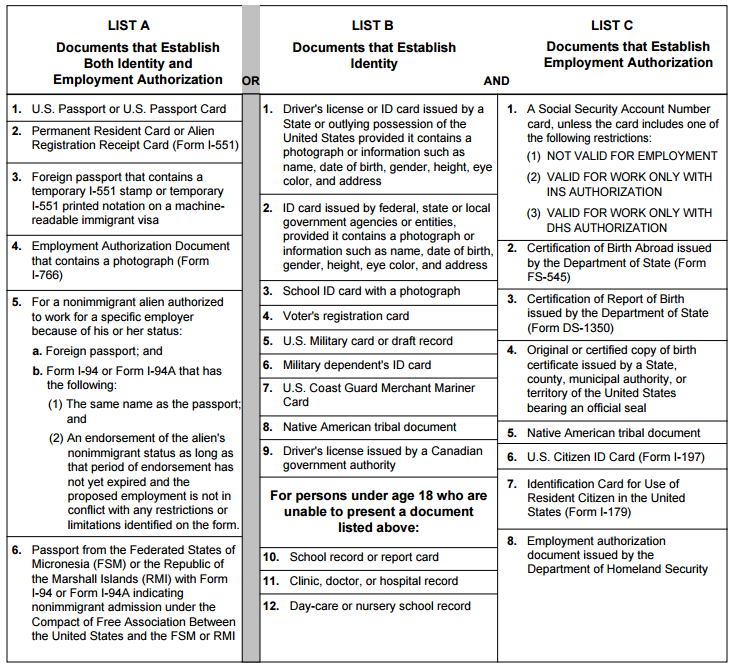

There are three lists of acceptable documentation. If the employee offers a document from List A, they only need one of those. If they want to offer from List B or List C, they need to provide one from each.

The lists of acceptable forms can be seen below:

Again, you must sign the form attesting to the fact that you verified the forms and can confirm, to the best of your knowledge, that the employee is authorized to work in the United States.

An employee can photocopy the forms, but are not required. Further, photocopies cannot replace physically filling out the form. That must also be done.

Section 3 of I-9 Form

Updating and Reverification

This last section is only for employees who have left the company and then were rehired, whose name changed, or if their authorization to work expired and they got a new one. For most candidates, this form isn’t ever really required.

The rules for completing this form are:

Block A: Only do this if the employee’s name changed at the time the employer completes Section 3

Block B: Complete this if the employee is still authorized to be employed and it is within 3 years of the date the form was originally created

Block C: Complete this if employment authorization or documentation of the employee is about to expire or if the employee has been rehired within 3 years.

Then sign and you’re good to go. U.S. citizens and noncitizen nationals or lawful permanent residents who presented a Permanent Resident Card in Section 2 are not required to reverify.

Justworks Can Help

Fortunately for you, there is an easier way to get all of this done. Justworks handles all of your compliance for you. When you hire a new employee, get them set up in Justworks and the documentation will be stored away for if/when the DHS comes asking for it.

Check out our newsletter

Monthly tips on running a business in your inbox.

Check out our newsletter

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.